how do you calculate cash flow to creditors

The operating cash flow basically shows the cash flow a. To prepare the cash flow from Financing we need to look at the Balance Sheet items Balance Sheet Items Assets such as cash inventories accounts receivable investments prepaid expenses and fixed assets.

Answered Cash Flow To Creditors The 2017 Balance Bartleby

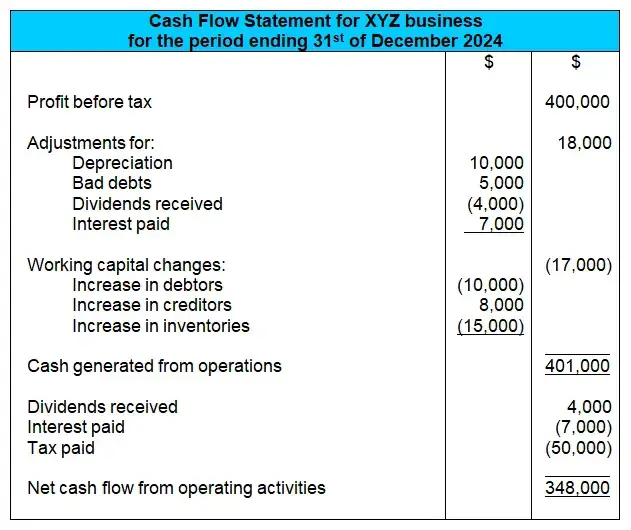

The calculation of cash flow for operating activities is usually compiled using the indirect method of presentation.

. Cash flow to stockholders is the amount of cash that a company pays out to its shareholders. Operating cash flow formula is represented the following way. Operating Cash Flow Net Income - Non-Cash Expenses Changes in Assets and Liabilities.

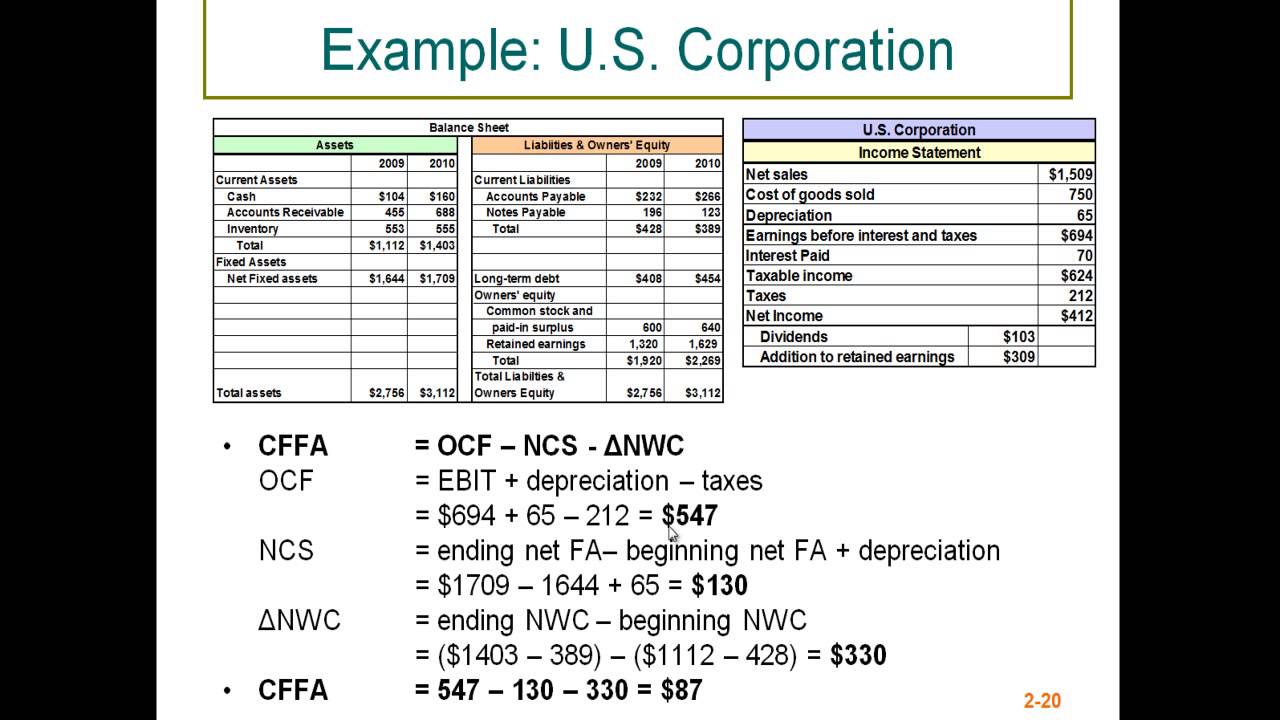

Basic Formula The basic formula for operating cash flow is earnings before interest and taxes or EBIT plus depreciation and minus taxes. Creditors have interest in your operating cash flow when deciding whether you are well-positioned to take on additional debt. Heres how to calculate the cash flow from assets.

Operating Cash Flow 352 million 32 million 65 million 98 million. F r e e C a s h F l o w O p e r a t i n g C a s h F l o w C a p i t a l E x p e n d i t u r e s. Thus the free cash flow formula is really simple.

Begin aligned text Free Cash Flow text Operating Cash Flow. Calculate the net cash flow from operating activities. Add up the inflow or money that came in from daily operations and delivery of goods and services.

Next calculate the outflow. 4 Formulas to Use Cash flow Cash from operating activities - Cash from investing activities Cash from financing activities Cash flow forecast Beginning cash Projected inflows Projected outflows Operating cash flow Net income Non-cash expenses Increases. DA deductions for depreciation and amortization.

Working method of operating cash flow is. Cash outflow is your fixed and variable bills. Beginning cash is of course how much cash your business has on hand todayand you can pull that number right off your Statement of Cash Flows.

Cash Flow to Maturing Debt Cash Flow From Operations Current Debt Maturities. T the amount of income tax. Take net income from the income statement Add back non-cash expenses Adjust for changes in working capital.

Cash Flow Statement A cash flow Statement contains information on how much cash a company generated and used during a given period. Cash Flow Forecast Beginning Cash Projected Inflows Projected Outflows Ending Cash. Liabilities such as long-term debt short-term debt Accounts payable and so on are all included in the balance sheet.

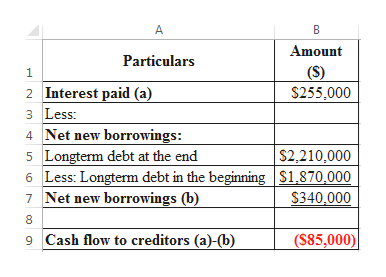

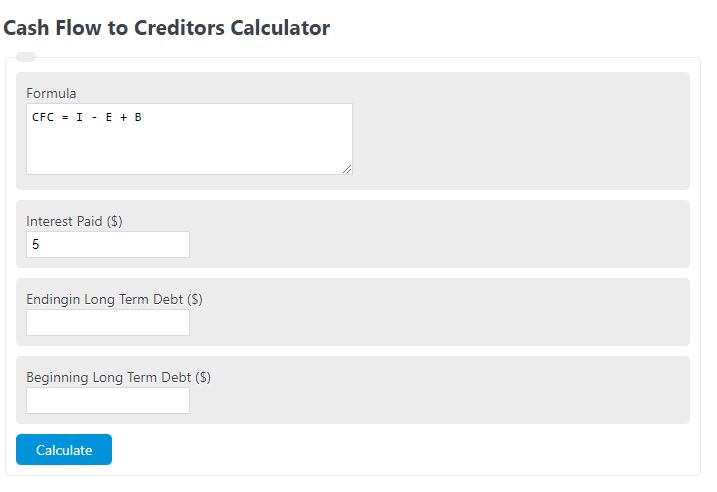

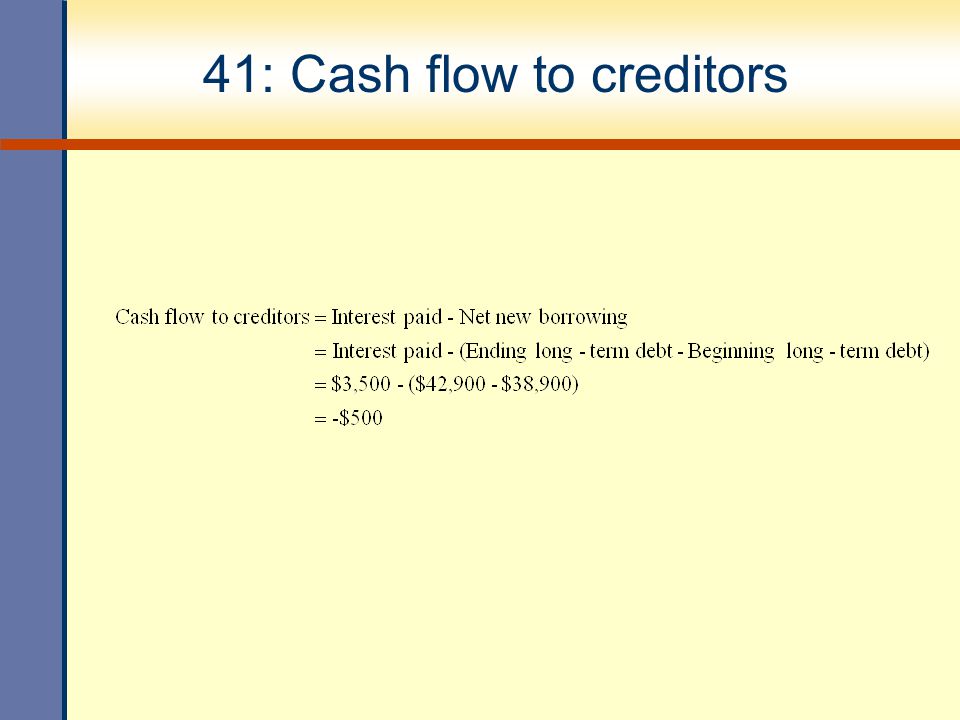

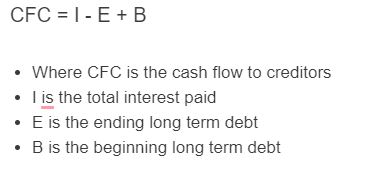

The Cash Flow to Creditors cf C is. Follow these three steps. Amount of Interest Paid i Ending Long Term Debt d E Beginning Long Term Debt d B Cash Flow to Creditors Calculator Results.

Calculator Precision Decimal Places 0 1 2 3 4 5 6 7 8 9 10. Calculate Cash Flow from Financing. The formula is.

How to Calculate Cash Flow. This presentation begins with net income or loss with subsequent additions to or deductions from that amount for non-cash revenue and expense items resulting in cash provided by operating activities. Cf C i - d E d B.

Operating cash flow formula. Cash Flow to Creditors cf C Formula and Calculations. Cash Inflow Cash Outflow Net Cash Flow.

Operating Cash Flow 221 million. Bettys Blooms Flower Shops had a -26500 cash flow from assets from July to December. Cash Flow Cash from operating activities - Cash from investing activities - Cash from financing activities Beginning cash balance.

Operating Activities 30000. Operating Cash Flow Formula. 18500 -15000 -30000 -26500.

Lets say your rent is 2000 and your monthly credit card payment is 400. Operating Cash Flow Operating Income Depreciation Change in Working Capital Taxes. Project inflows are the cash you expect to receive during the given time period.

In order to perform a cash flow analysis youll first need to prepare your cash flow statement. This is a negative cash flow. A similar metric is the cash flow to total debt ratio which is among the ratios used by credit rating agencies.

Include income from collection of receivables from customers and cash interest and dividends received. But maybe you had to pay back a relative who loaned you 300 to. Heres how this formula would work for a company with the following statement of cash.

Is one of the three key financial statements that report the cash generated and spent during a specific period of time eg a month quarter or year. A positive cash flow is good for the company as it determines financial success and a negative cash flow says otherwise. One of the ways to generate cash flow from assets would be operating activities.

You know youll be on the hook for 2400 each month. This shows they spent more than they earned in. Investing Activities 5000.

The statement of cash flows acts as a bridge between the. Your cash inflow is your net income. Investors routinely compare the cash flow to stockholders to the total amount of cash flow generated by a business to measure the potential for greater dividends in the future.

A cash flow statement allows you to track the amount of cash your business has coming in and how much it has going outor simply put the amount of money youll have availablein a given period of time. EBIT profit from the main activity ie the amount of the companys profit before taxes and interest. OCF EBIT DA-T where.

Net Income is calculated using the formula given below. This amount is the cash dividends paid during a reporting period. It is noteworthy that this amount will equal cash flows to creditors plus cash flows to stockholders which shows how you can draw a line between this and the balance represented by the accounting equation.

Cash Flow To Creditors Calculator Calculator Academy

Financial Statements Taxes And Cash Flow Ppt Video Online Download

The Indirect Cash Flow Statement Method

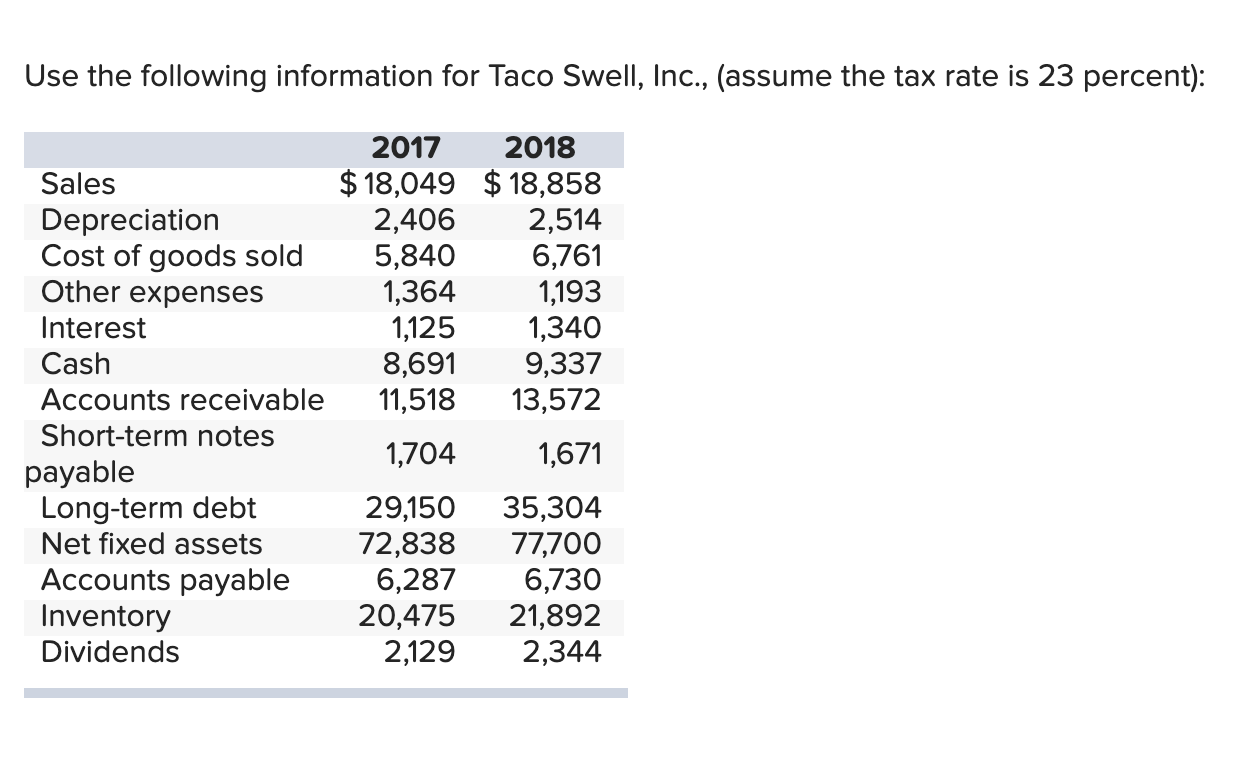

Solved Use The Following Information For Taco Swell Inc Chegg Com

Cash Flow To Creditors Calculator Calculator Academy

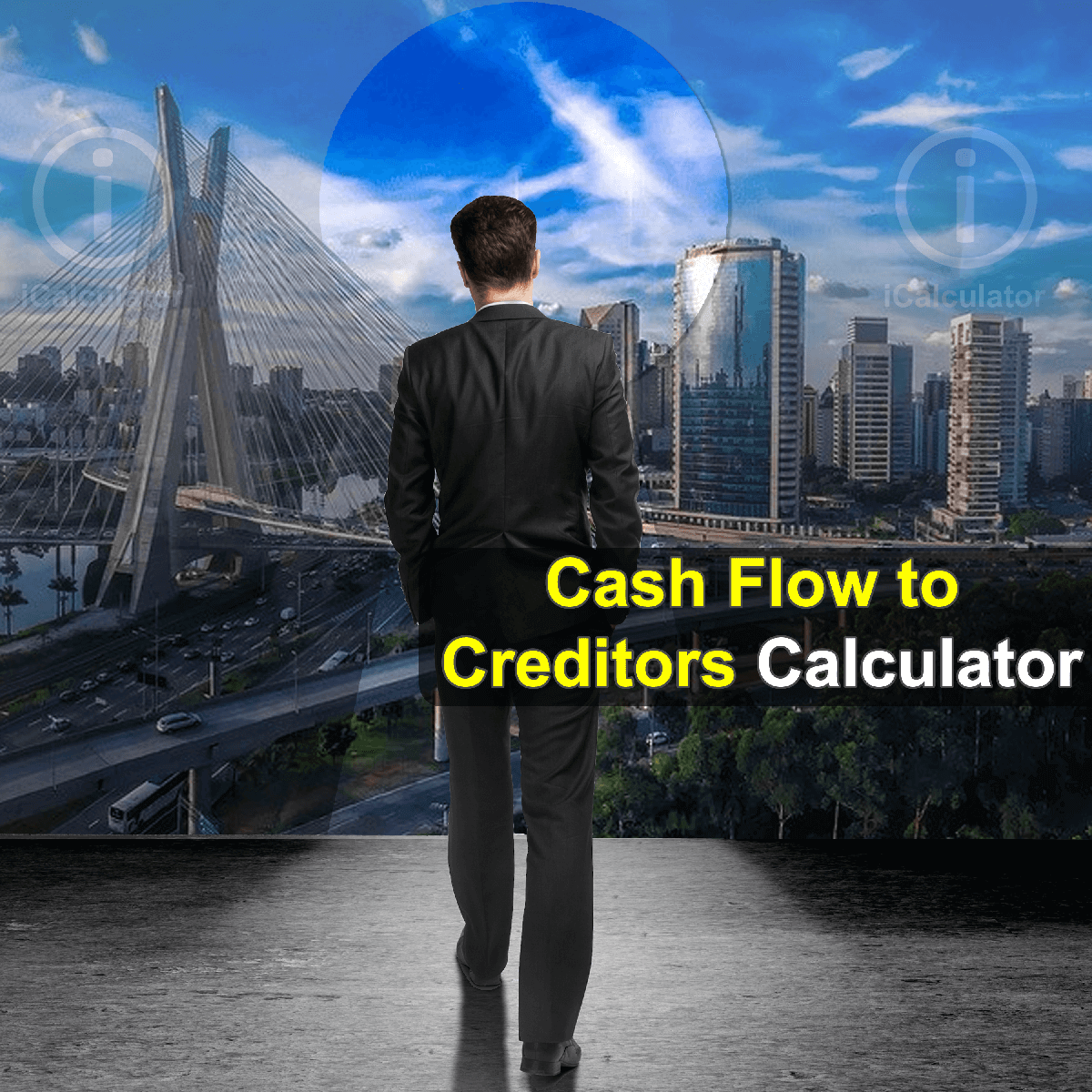

Solved For 2018 Calculate The Cash Flow From Assets Cash Chegg Com

Financial Statements Taxes And Cash Flow Ppt Video Online Download

Chapter 2 Financial Statements Taxes And Cash Flow

Cash Flow To Creditors Calculator Finance Calculator Icalculator

Solved For 2018 Calculate The Cash Flow From Assets Cash Chegg Com

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

/applecfs2019-f5459526c78a46a89131fd59046d7c43.jpg)